Bankruptcy: The Legal Reset That Can Stop Foreclosure — But Not Without Consequences

Bankruptcy is one of the most misunderstood options for homeowners facing foreclosure. Some people think it’s only for people with no money left. Others think it’s a magic fix for everything. The truth is somewhere in the middle: bankruptcy is a powerful legal tool, but it comes with serious consequences and should be used strategically, not emotionally.

When done correctly, bankruptcy can pause foreclosure instantly.

When done incorrectly, it can make things much worse.

Let’s walk through the full picture — clearly, simply, and without judgment.

What Bankruptcy Actually Does

No matter which chapter you file (7 or 13), bankruptcy immediately triggers something called the automatic stay.That means:

- Foreclosure stops

- The auction is paused

- All collections stop

- Lawsuits pause

- Wage garnishments stop

- Creditors cannot legally contact you

It’s like hitting a big red “freeze everything” button. But that does not mean the foreclosure is permanently gone — only paused.

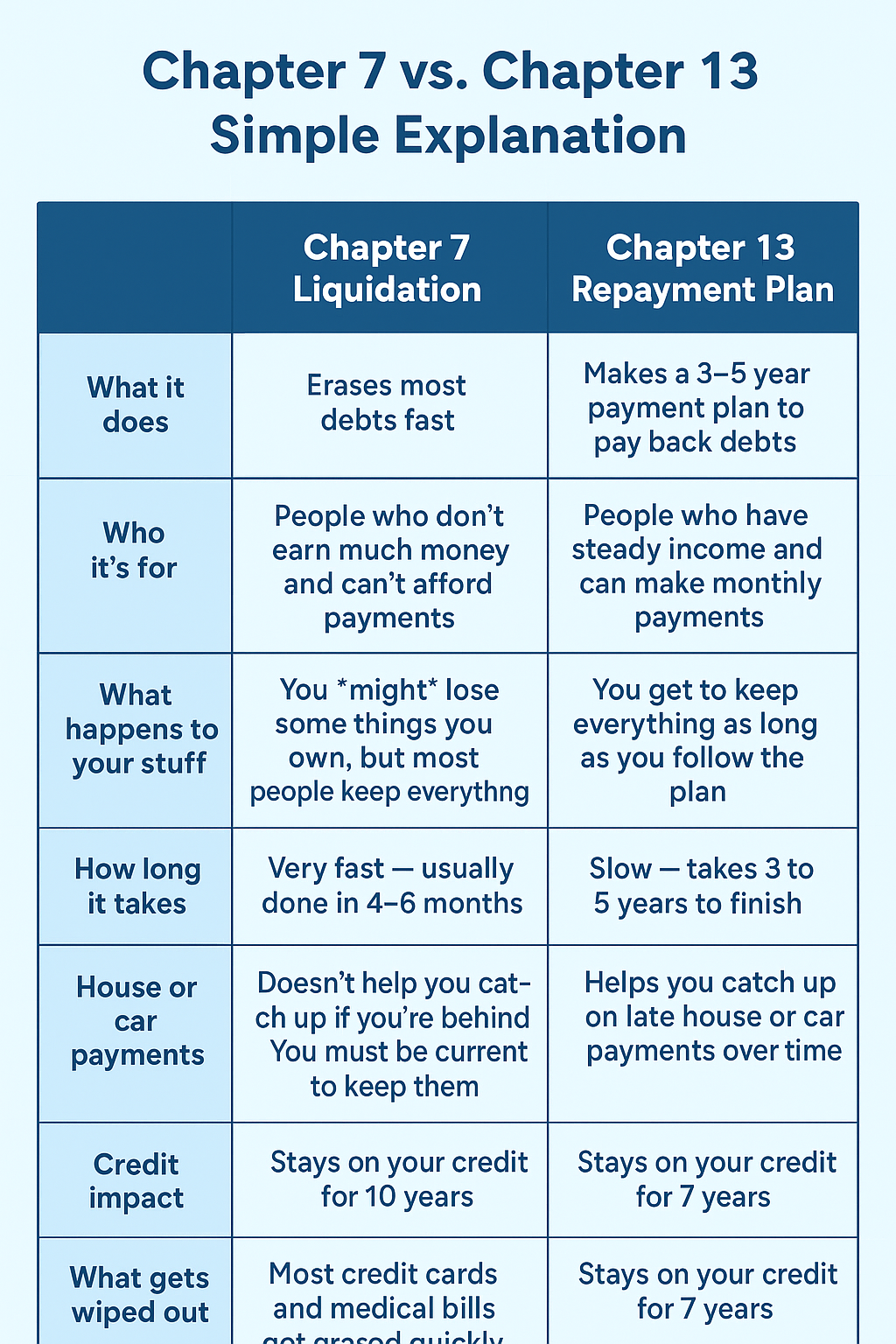

Chapter 7 vs. Chapter 13: The Big Differences

Bankruptcy comes in two main forms for homeowners. Understanding the difference is critical.

Chapter 13: The “Repayment Plan” Bankruptcy

Chapter 13 is designed for people who have steady income and want to save their home.What it does:

- Creates a 3–5 year repayment plan

- Lets you catch up on missed mortgage payments

- Lets you keep your home as long as you make payments

- Allows you to reorganize other debts (credit cards, medical bills, etc.)

- Protects your home from foreclosure as long as you follow the plan

Best for homeowners who:

- Fell behind but can afford a steady monthly repayment

- Want to keep their home long term

- Need time to catch up

- Want to roll some debts together

Chapter 7: The “Fresh Start / Liquidation” Bankruptcy

Chapter 7 eliminates most unsecured debts (credit cards, medical bills, personal loans) but does not allow you to catch up on your mortgage.What it does:

- Wipes out most unsecured debts

- Pauses foreclosure temporarily

- Does NOT provide a way to reinstate your loan

- Usually lasts 3–6 months

- May require selling certain assets (depending on exemptions)

Best for homeowners who:

- Cannot afford the mortgage anymore

- Need time to exit the home

- Want debt wiped out before moving or selling

- Have very limited income or assets

Risks & Downsides of Bankruptcy

Bankruptcy is powerful — but not gentle. Here’s what to consider:

1. Major Credit Impact

Bankruptcy stays on your credit report for:

- 7 years (Chapter 13)

- 10 years (Chapter 7)

2. Public Record

Your bankruptcy becomes a public record.

3. Expensive

Attorney fees for Chapter 13 can be $3,000–$5,000 or higher (often rolled into the repayment plan).

Chapter 7 fees range from $1,500–$2,500.

4. Strict Rules

Missing payments in Chapter 13 can cause the case to be dismissed and foreclosure restarted.

5. Emotional Toll

Bankruptcy is stressful and can affect future financial opportunities.

6. Not All Debts Are Erased

Certain debts (taxes, student loans, child support, alimony) usually stay.

7. Chapter 7 Doesn’t Save Your Home

It only delays foreclosure — it does not fix the mortgage problem.

Is Bankruptcy Right for You?

Choose Chapter 13 if:

- You want to keep your home

- You have steady income

- You need time to catch up

- You can handle a structured payment plan

Choose Chapter 7 if:

- You cannot afford your mortgage anymore

- You’re planning to move or sell

- You want unsecured debt eliminated

- You need time before foreclosure continues

Avoid bankruptcy if:

- You can qualify for a loan modification

- You can reinstate the loan

- You can sell the home before auction

- You don’t want long-term credit damage

Bankruptcy should be a strategic final option, not the first one you jump to.

Final Thoughts

Bankruptcy can absolutely save a home in the right situation — especially Chapter 13.

It buys time, stops the foreclosure machine, and gives you a structured path forward.But it also comes with consequences: long-term credit impact, strict rules, and major costs.The best approach is to understand all your options, run the numbers, and decide based on what gives you the most stability over the next 3–5 years.You don’t need to make this decision alone.

We’re Here For You

If you’re confused about whether bankruptcy makes sense — or you want to explore alternatives that don’t damage your credit — we’re here to walk with you.

Feel free to call or text (210) 570- 4787

No judgment.

Just honest guidance.