Sell Your House & Stop Foreclosure

Every homeowner’s situation is different.

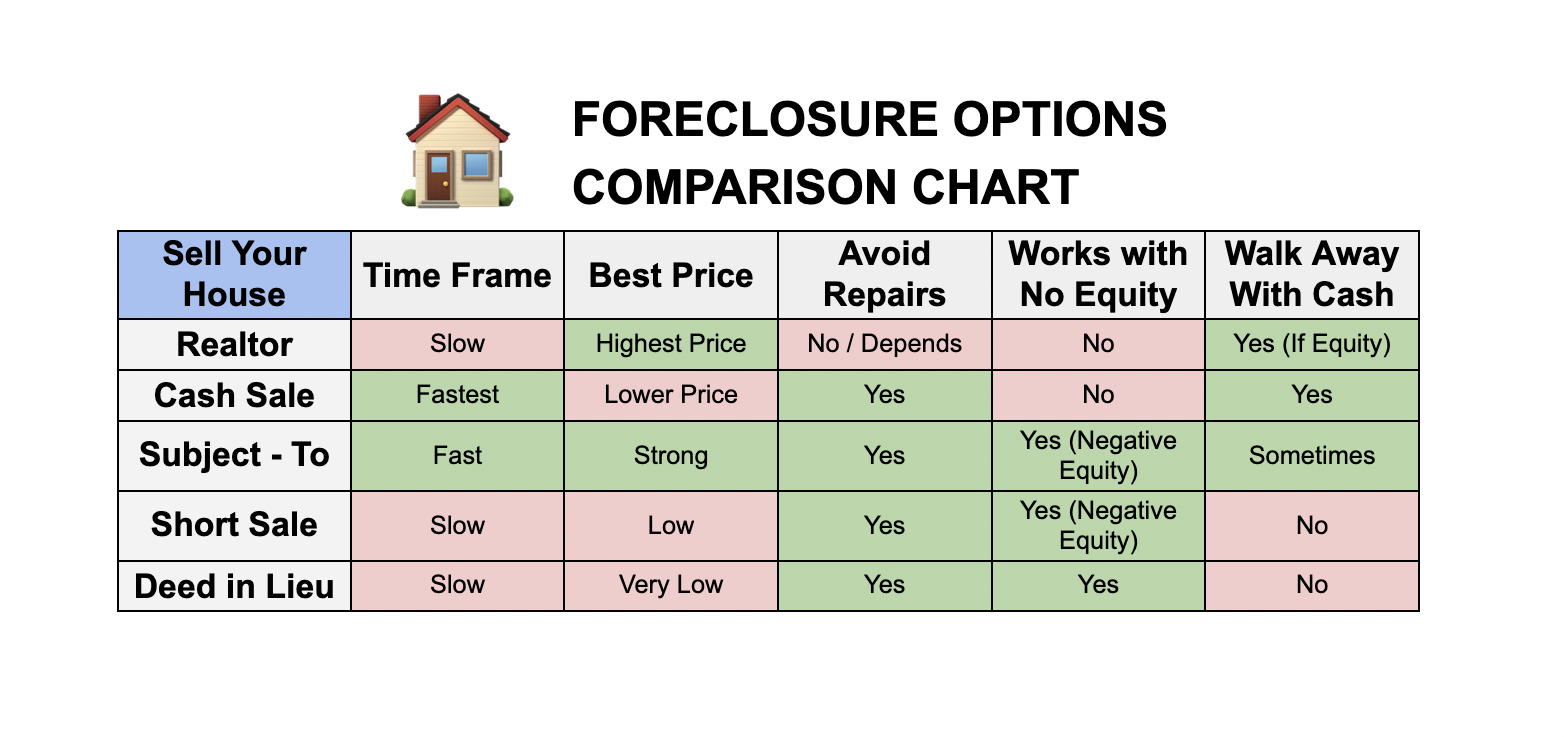

Below are the most common paths people take when they’re trying to sell their home. Each option is short, simple, and explained in plain English.

No pressure. No sales pitch. Just clarity.

Option #1: List with a Trusted Realtor

- What it is: List the home on the open market to get the highest possible price — as long as there’s time.

- Good for: Homeowners with equity, a home in decent shape, and at least 60–90 days before the auction date.

- Quick Process: Agent lists → buyers tour → highest offer accepted → foreclosure paused during closing.

Learn how listing can protect your equity.

Option #2: Cash Sale (Fast & Hassle-Free)

- What it is: A quick, as-is sale for homeowners who want speed, simplicity, and a guaranteed closing.

- Good for: Homes that need repairs, tight timelines, or auction dates approaching fast.

- Quick Process: Walkthrough → on-the-spot cash offer → you pick the closing date → we handle all paperwork and fees.

See how a cash sale works and what your offer might look like.

Option #3: Subject-To (We Take Over the Mortgage)

- What it is: We step in and take over your existing loan payments, catch up the arrears, and stop foreclosure — while the mortgage stays in your name temporarily.

- Good for: No equity, behind on payments, or out of time — but wanting to avoid foreclosure and move on cleanly.

- Quick Process: Review the loan → catch up missed payments → transfer ownership → we take responsibility from there.

Understand how subject-to works and why it’s a powerful foreclosure option.

Option #4: Short Sale

- What it is: Sell the home for less than what you owe — with the bank’s approval — to avoid foreclosure.

- Good for: Homes with negative equity or major repairs that make a full payoff impossible.

- Quick Process: Apply with lender → bank approves reduced payoff → home sells → remaining debt typically forgiven.

Learn when a short sale makes sense and how it protects your credit.

Option #4: Deed in Lieu of Foreclosure

- What it is: You voluntarily sign the property back to the lender instead of going through a foreclosure sale.

- Good for: Homeowners with no other selling options who want to avoid a foreclosure on their record.

- Quick Process: Request review → lender approves → deed transferred → foreclosure canceled.

See how a deed in lieu compares to a full foreclosure.

Ready for Clear Answers and Next Steps?

Whether you want to keep your home or sell it, we walk through every option with you — step by step — so you never feel lost or pressured.

Call or text: 210-570-4787

No obligations. No pressure. Just help.

Call or text: 210-570-4787

No obligations. No pressure. Just help.